Fewer resale landed transaction in June; modest resale gains amongst top gainers

Based on URA Realis caveat data, about 118 landed homes were transacted on the resale market in May 2024; the combined transaction value came up to $583 million - significantly down from May (160 deals valued at nearly $940 million). Upon an analysis of each transaction and their respective gains, most landed deals were profitable. The top 10 landed home transactions in June booked gains ranging from about $3.5 million to $6.8 million. The top gainers were scattered across the island; six out of the top 10 landed transactions are located in the Outside Central Region (OCR), another four in the Core Central Region (CCR); there were no top 10 landed transactions in the Rest of Central Region (RCR) during the month.

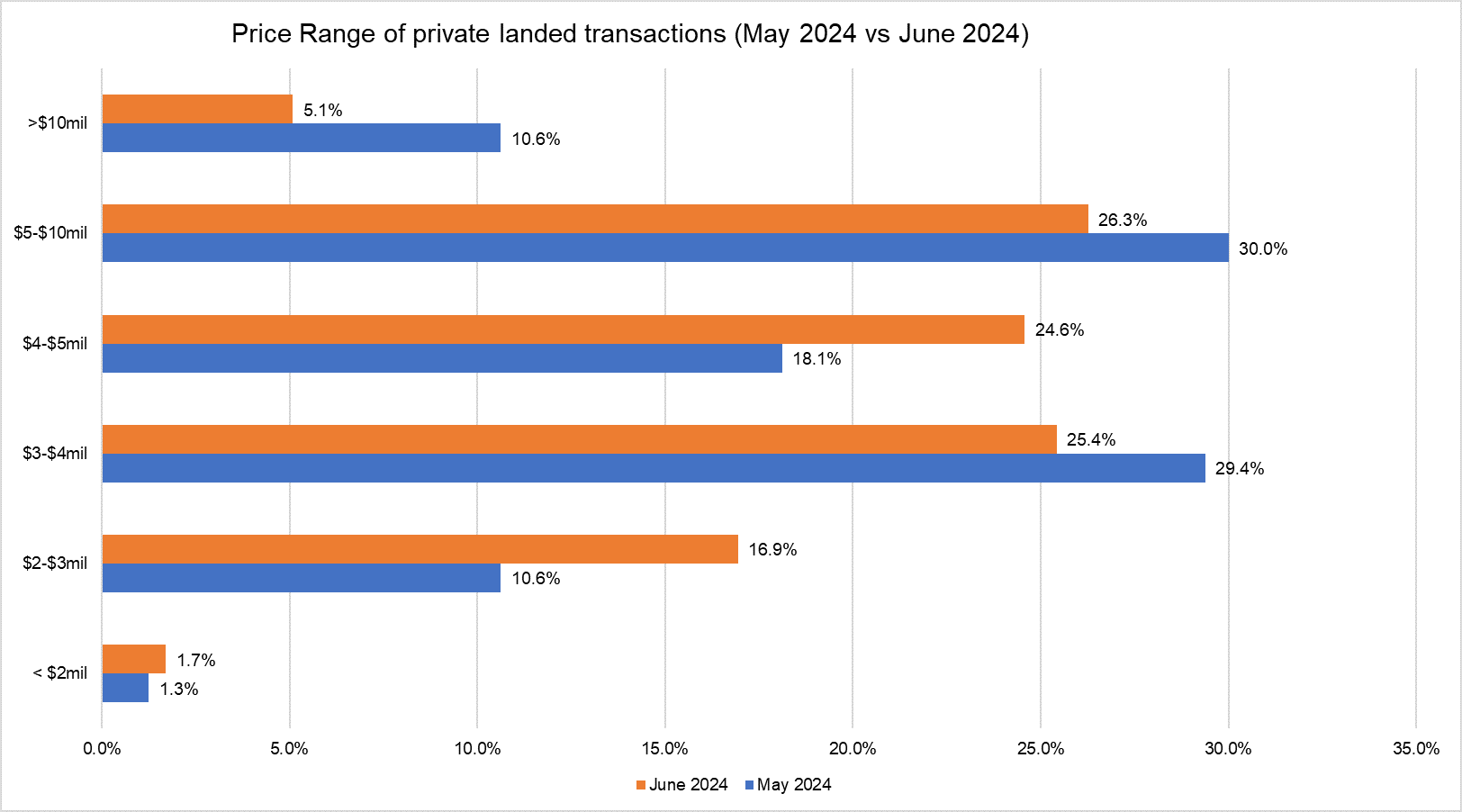

The landed home resale activity in June dialled down further following a quiet May. Amidst the slower sales in June, there was a lower proportion of higher priced landed homes being sold compared with the previous month. Based on URA Realis caveat data, about 31.4% of resale landed homes sold in June were priced at $5 million and above, compared with about 41% in May. Meanwhile, 68.6% of the resale landed transactions were priced at below $5 million in June - higher than the 59% proportion in the previous month.

Chart 1: Price range of private resale landed transactions in May 2024 vs June 2024

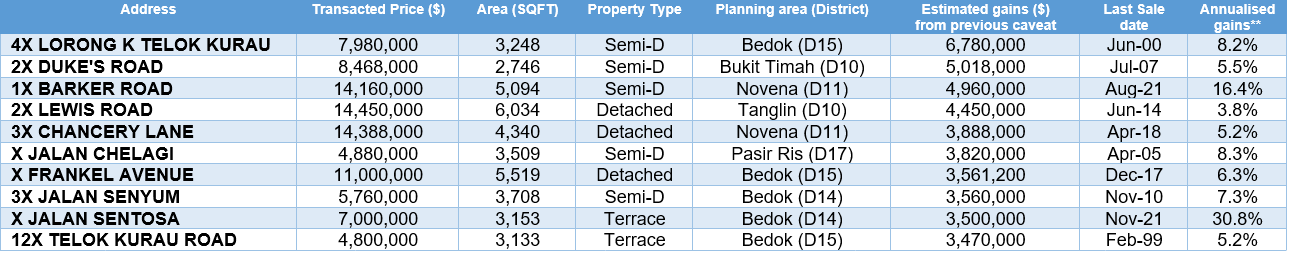

Top 10 resale landed transactions in terms of estimated gains*

Top landed transaction with highest gains (overall)

The top landed transaction in the month was for a semi-detached property in the OCR, along Lor K Telok Kurau in District 15. The property was recently redeveloped and is situated within the Frankel landed estate, in the eastern region. The semi-detached home was sold for $7.98 million in June and achieved a gross profit of $6.78 million from the last caveated price lodged in June 2000 - booking an annualised gain of 8.2%. This freehold property sits on a plot with a land area of over 3,200 sq ft; the sale price reflects a unit price of $2,457 psf on land area. The property is a 15-minute walk to the Marine Terrace MRT station on the Thomson-East Coast Line, which take residents to the city centre within 20 minutes.

Top landed transaction with highest gains (Core Central Region)

The top landed transaction in the month in the CCR was for a semi-detached house along Duke's Road (District 10). The property was sold for nearly $8.5 million in June and achieved a gross profit of $5.018 million from the last caveated price lodged in July 2007 - booking an annualised gain of 5.5%. This freehold property sits on a plot with a land area of more than 2,700 sq ft, with the sale price reflecting a unit price of $3,084 psf on land area. The property is within walking distance to the Botanic Gardens MRT station on the circle line and downtown line. The property is located close to several amenities the vicinity, including the Botanic Gardens, The Crown Centre, Coronation Plaza, Serene Centre, Cluny Centre amongst others.

The second-best performing transaction in the city was for another semi-detached house in Bukit Timah (District 10) along Barker Road. The property is just a short walk to the ACS (Barker Road) Campus. The freehold property is a stone's throw from the Newton MRT station on the Downtown Line and North-South Line, which take residents to the city in less than 15 minutes. It was sold for nearly $14.2 million in June, with its last caveat being lodged in August 2021. The sale price is up by about $4.96 million from the previous caveated price, marking an annualised profit of 16.4% over less than 3 years. Based on a land area of 5,094 sq ft, the sale price reflects a unit price of $2,780 psf on land area.

The third best-performing landed transaction in the CCR was for a freehold bungalow along Lewis Road in the Tanglin planning area (District 10). The bungalow is located within the Dalvey Estate Good-Class Bungalow area (GCBA), one of Singapore's most prestigious landed enclaves. The property was sold for about $14.45 million, reflecting an estimated gain of more than $4.45 million, which represents an annualised gain of 3.8% per year from its last caveat lodged in June 2014 - with a holding period of 10 years. The property is a short walk from the Stevens MRT station, on the Downtown Line, which takes residents to the city in less than 20 minutes.

Top landed transaction with highest gains (Outside Central Region)

The second most profitable deal in the suburbs in June was the sale of a semi-detached home in Jalan Chelagi in Pasir Ris (District 17). The property was sold for about $4.88 million, up by $3.82 million from the last caveat lodged in April 2005. This reflects an annualised profit of 8.3% over a holding period of more than 19 years. The property is just a short drive to the work hubs at Changi Business Park, Changi Airport and Tampines Regional Centre.

The third best-performing landed home transaction in the OCR was for a 2-storey bungalow along Frankel Avenue in the Bedok planning area (District 15). The property was sold for about $11 million, reflecting an estimated gain of some $3.5 million, representing an annualised gain of 6.3% per year from its last caveat lodged in December 2017- with a holding period of more than 6 years. The property is located just a short walk to Marine Terrace MRT station on the Thomson-East Coast Line (TEL), which takes commuters to the city centre in less than 30 minutes. The property is also just a short walk to the stretch of shophouses along East Coast Road, which houses some popular eateries and eclectic cafes.

Of note, there was a terrace house sale in the OCR which made the top 10 rankings. The Jalan Sentosa freehold terrace in District 14 (Bedok) was sold for $7 million, up by about $3.5 million from the last caveat lodged in November 2021 - this reflects an eye-watering annualised profit of 31% after a short holding period of less than 3 years. The terrace house is situated within a short 10-minute walk to Kembangan MRT station on the East-West Line, which takes commuters to the city within 30 minutes. It is also a short drive to other regional work hubs in the east such as Tampines, Changi Airport and Expo.

If you are looking for high-end homes or good class bungalows in Singapore, contact PropNex's GCB and Prestige Landed department for buying opportunities and insights on the landed residential property market.

For more property research insights, join PropNex Friends today.

Read the latest PropNex Research report on the GCB and Prestige Landed homes market.

Explore Your Options, Contact Us to Find Out More!

Selling your home can be a stressful and challenging process, which is why

it's essential to have a team of professionals on your side to help guide you through the journey. Our

team is dedicated to helping you achieve the best possible outcome when selling your home.

We have years of experience and a proven track record of successfully selling homes in a timely

and efficient manner.